2021-10-13 07:39:00

Soaring oil prices should be taking a bite out of the stock market, or at least weighing on energy-sensitive sectors, by now, according to historical data. So far, that’s not the case.

Using data going back to 1986, the S&P 500 index

SPX,

+0.31%

has seen three-month forward returns feel a pinch, coming in below average, when oil rises into the ninth decile, said Kevin Dempter, an analyst at Renaissance Macro Research, in a Wednesday note. The oil rally, which took the U.S. benchmark

CL00,

-0.14%

above $80 a barrel for the first time since 2014 this week, has taken prices above the threshold.

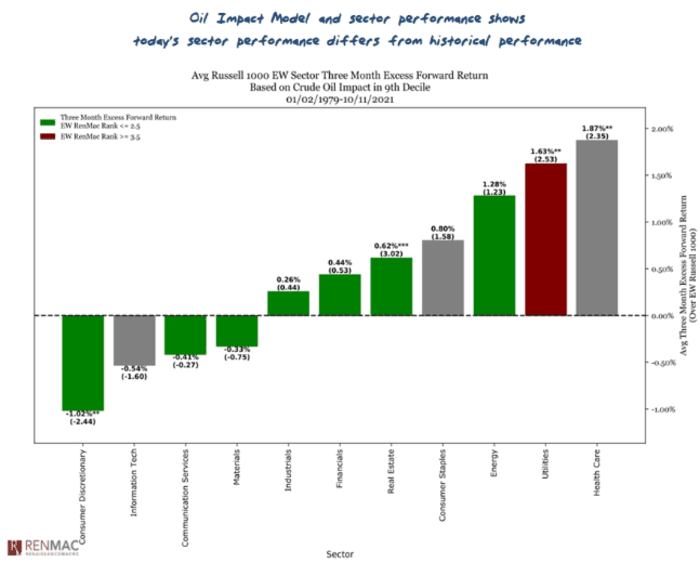

But, as he illustrated in the chart below, sector performance isn’t lining up with history.

Renaissance Macro Research

A look at historical sector performance shows that when the oil price is in its current decile, healthcare, utilities and energy sectors perform best, while consumer discretionary, technology and communications services perform worst.

“Today’s sector performance does not line up with the historical performance according to the oil impact model, which suggests that as of now, rising oil prices aren’t having as much of an impact as they have in the past,” Dempter wrote.

It makes sense that the discretionary sector has historically performed worst due to rising oil prices, he said, as rising costs take the marginal dollar from the consumer. Current trends for discretionary stocks, however, are still generally bullish, he noted.

Related: Gasoline prices at a 7-year high may take a ‘bite out of holiday spending’: GasBuddy

That said, there has been some deterioration in apparel-related names, Dempter said, with the relative performance of both the equal-weight S&P 1500 Apparel Retail and Apparel, Accessories & Luxury Goods subindustries slipping below their 200-day moving averages and trading at or near levels that would mark a negative trend change.

Stocks have seen modest pressure this week, with major indexes mostly lower on Wednesday as earnings season unofficially kicked off. The Dow Jones Industrial Average

DJIA,

+0.00%

was down just shy of 180 points, or 0.5%, while the S&P 500 edged down 0.3%. The Nasdaq Composite

COMP,

+0.73%

bucked the softer tone, edging up 0.2%.