Not exactly breaking news BUT Gold is looking strong these days… Have you noticed?? What are the primary factors that impact the gold markets?

The US dollar – Gold and the US dollar are inversely correlated about two-thirds of the time (when one rises the other tends to fall, and vice versa).

Investment demand for physical gold – on the rise.

Central bank buying – Central banks around the world hold gold as a reserve asset. If they think they need more, they buy more.

Trading volumes on the COMEX – Traders at the world’s largest futures market are buying more gold contracts than ever before, a staunchly bullish indicator. And when you buy more than you sell, the price is driven higher.

New mine supply – Most gold analysts recognize that new supply from gold producers is set to decline. The concerning thing about the coming gold supply deficit is that it doesn’t require an outside force to make it happen. It’s locked in. Further, producers can’t easily or quickly increase mine output even if gold prices jump, as you’ll see.

Coming economic and monetary factors – one of the primary reasons gold is doing well is because of the numerous elevated risks that are present. NUMEROUS. The Pandemic is an excellent example and the recovery will be slow.

General consensus amongst the experts is that gold will continue to rise into 2021 and then have the potential to reach anywhere from $3,000 to $8,000 over the next 5 years. There are many factors, of course, that could impact the gold price in both the short and long term.

AND we can go on and on about “experts” but lets’ just hold onto this last thought on the potential future highs of gold and explore two of the companies that CEOdigest has an interest in. At CEOdigest our love for Gold is strong given where we think it is heading…

Falcon Gold Corp. (TSX-V:FG) www.falcongold.ca 4 Gold, Properties, Ongoing Drill, COVID Immunity

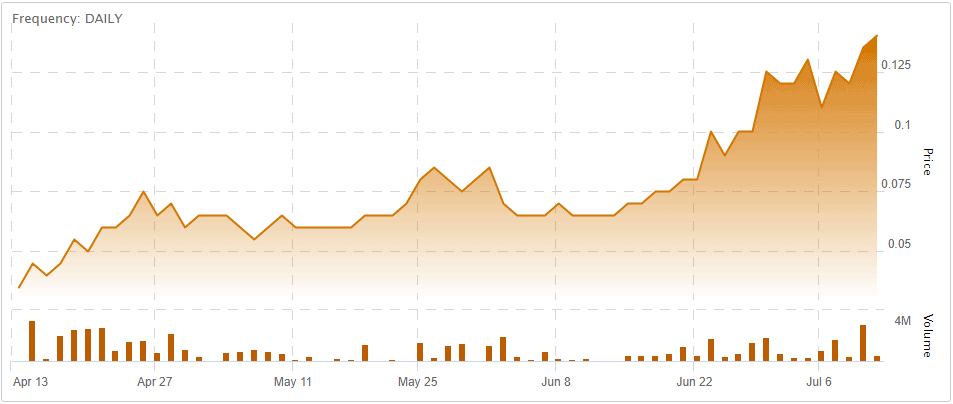

CEOdigest has been following and supporting Falcon since it was below $0.04 for a few important reasons. The primary reason is the understanding of the management team lead by Karim Rayani. This is a team that believes in themselves first, above any project that they might acquire. Have a look at their SEDI filings if you’re not clear on that as they have put their money where their drills are. Those drills are currently turning in Atkiokan on the Central Canada project expanding on historical finding with drill intercept showing assay values as high as 18.6 g/t Au. Additional assays are expected back soon from the hole that showed the visible gold as well as others. Management is very pleased and cautiously optimistic about the visual inspection of the cores. As mentioned, one had visible gold.

Falcon has put together several high volume days in a row now and has continued to increase its audience which includes coverage from news letter writers and investment groups. With gold looking as strong as it has and money coming into the till like it has you can expect falcon to keep the drills turning and looking for additional opportunities. The share price has recently touched $0.145 and we believe Falcon is just getting started and will very soon become a name synonymous with the Red Lake and Atikokan districts of Ontario.

Today people might be asking how close is Falcon to BTU Metals Corp. (TSX-V:BTU). Tomorrow they might be asking how close BTU is to Falcon. Falcon is a high risk exploration play, but if this is your sweet spot as an investor and you have an appetite for gold exploration you’ll be seeing steady news flow here.

International Montoro Resources Inc. (TSX-V:IMT) www.montororesources.com 7 Properties (Gold, Uranium, Nickel, Copper, Cobalt, Vanadium), Under New Management, COVID Immunity

CEOdigest has just become a very large fan of International Montoro although we have been watching this company for some time given its joint venture partnership with Falcon Gold Corp. on the Camping Lake Gold Project in Red Lake Ontario.

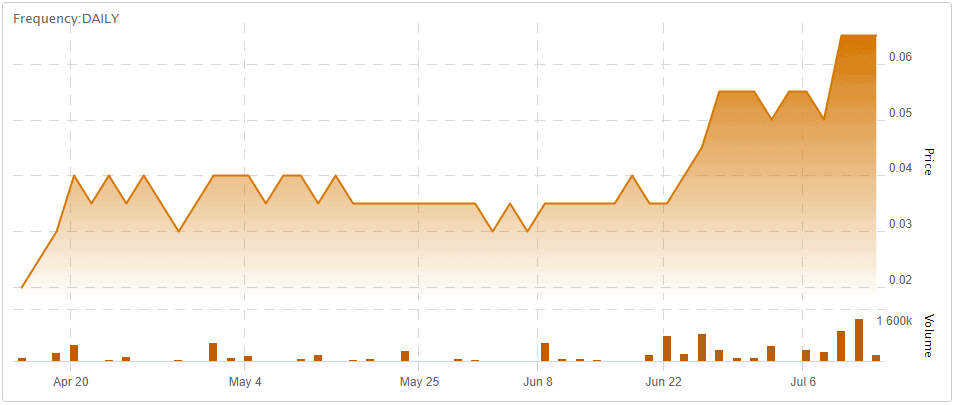

But our excitement for this company just Got Real moving to the next level with the announcement of Karim Rayani as the new Chief Executive Officer and Director on July 9th 2020. If you think you see a chart resembling Falcon Gold from a few months back you are probably right. With a recent financing to get the ball rolling you can count on some news flow soon to get some result coming your way.

International Montoro has an option to earn a 51% interest in the Camping Lake property and can acquire a further 24% interest (for a total of 75%) for C$500K. Approximately 20 km south of Great Bear’s discoveries at Dixie Lake, and 8 km south of BTU Metals Corp’s base metals targets you’ll find the Camping Lake property. Will Karim Rayani make things happen here? CEOdigest thinks so. What does that mean? You’ll soon find out.

International Montoro is another high risk exploration play. CEOdigest hasn’t even touched on the other properties in this play because it doesn’t have to at this time. The new management, recent raise and Camping Lake in a strong gold market? You’re going to see news flow here as well. Time to pull up a chair on this one.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by CEOdigest about Falcon Gold or International Montoro, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. CEOdigest is not responsible under any circumstances for investment actions taken by the reader. CEOdigest has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. CEOdigest is not directly employed by any company, group, organization, party or person. The shares of Falcon Gold and International Montoro are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Falcon Gold and International Montoro was an advertiser on CEOdigest did not own shares in the Companies.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. CEOdigest is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. CEOdigest is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. CEOdigest is not an expert in any company, industry sector or investment topic.